The global natural rubber industry is experiencing a transformative shift, with Processing aids for natural rubber emerging as a critical catalyst for efficiency, quality, and sustainability. As demand for high-performance rubber products surges across automotive, industrial, and consumer sectors, these specialized chemical compounds have become indispensable to manufacturers seeking to optimize production processes while meeting evolving environmental and performance standards. Recent market data and technological advancements underscore the growing significance of Processing aids for natural rubber, positioning the segment for robust growth in the coming decade.

The global market for Processing aids for natural rubber has witnessed steady expansion, driven by rising production volumes of natural rubber and the need for enhanced processability. According to industry research, the global market size for these essential additives reached approximately $22.84 billion in 2024, with a projected compound annual growth rate (CAGR) of 5.6% from 2025 to 2031. This growth trajectory is expected to push the market value to $33.3 billion by 2031, reflecting the increasing reliance on Processing aids for natural rubber across key manufacturing hubs worldwide.

Regional dynamics play a pivotal role in this expansion, with Asia-Pacific leading the global market with a 59% share, followed by Europe (21%) and North America (14%). The dominance of the Asia-Pacific region stems from its status as a major producer and consumer of natural rubber, with thriving automotive and industrial sectors driving consistent demand for Processing aids for natural rubber. Manufacturers in these regions are increasingly adopting advanced processing aids to address production challenges such as material waste, energy inefficiency, and inconsistent product quality, further amplifying market growth.

Downstream applications remain a key driver, with the automotive industry accounting for 69% of global demand for Processing aids for natural rubber. From tires to seals and hoses, natural rubber components are integral to vehicle performance, and processing aids ensure these parts meet stringent requirements for durability, elasticity, and resistance to wear. Industrial and medical sectors also contribute to market demand, as processing aids enable the customization of rubber properties for specialized applications, from heavy-duty industrial equipment to sterile medical devices.

Innovation in Processing aids for natural rubber has focused on dual priorities: boosting production efficiency and reducing environmental impact. Traditional processing aids, often derived from petroleum, have long been used to improve mold flow, reduce mixing viscosity, and optimize curing cycles. However, recent advancements have introduced sustainable alternatives that maintain or exceed these performance benefits while aligning with global sustainability goals.

One notable breakthrough is the development of bio-based Processing aids for natural rubber, such as liquid guayule natural rubber (LGNR). Derived from the guayule plant—a renewable source of natural rubber native to arid regions—LGNR serves as an eco-friendly alternative to petroleum-based processing oils like naphthenic oil (NO). Research has demonstrated that LGNR not only improves the processability of natural and synthetic rubber composites but also enhances key mechanical properties. Unlike NO, which can reduce tensile strength, LGNR increases tensile strength and elongation at break while maintaining thermal stability and ozone resistance. These benefits make bio-based Processing aids for natural rubber particularly attractive to manufacturers aiming to reduce their carbon footprint without compromising product quality.

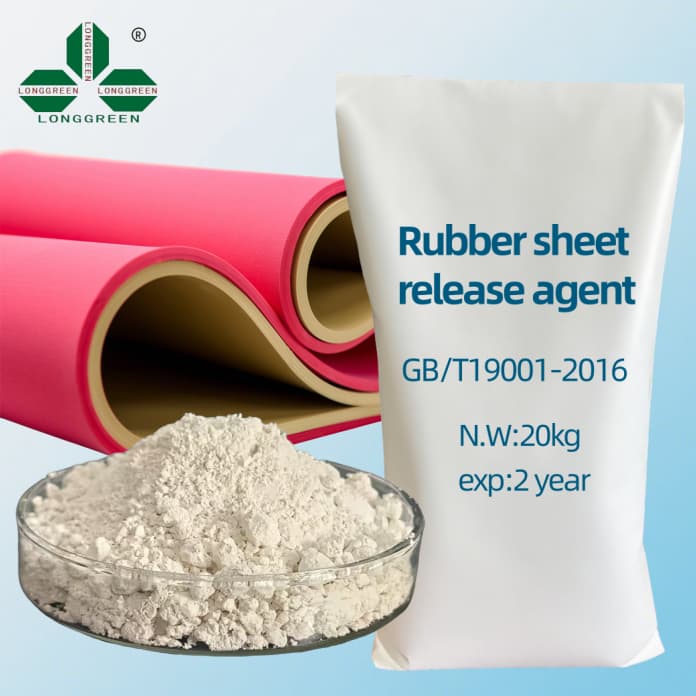

Technological advancements have also focused on optimizing the functional benefits of Processing aids for natural rubber. Modern formulations enhance mold flow efficiency by up to 20%, ensuring rubber compounds fill molds accurately and consistently. This reduces the number of defective products, improves production yield, and shortens cycle times—directly translating to cost savings for manufacturers. Processing aids also improve release properties, preventing rubber from sticking to molds during demolding and minimizing product damage. Additionally, these additives precisely control the vulcanization process, allowing manufacturers to tailor rubber hardness, elasticity, and tensile strength to meet specific application requirements.

Energy efficiency is another key area of innovation for Processing aids for natural rubber. By reducing the viscosity of rubber compounds, processing aids lower the energy required for mixing and molding, contributing to significant operational savings. For instance, LGNR has been shown to reduce compounding energy consumption similarly to traditional petroleum-based aids, while offering superior aging protection and mechanical performance. This combination of energy efficiency and sustainability positions modern Processing aids for natural rubber as a cornerstone of green manufacturing practices.

Processing aids for natural rubber encompass a diverse range of product types, with tackifiers being the largest segment, accounting for 33% of the global market. Tackifiers improve the adhesion of rubber compounds, a critical property for applications such as tires and conveyor belts. Other major segments include homogenizers, plasticizers, dispersants, and anti-scorching agents, each addressing specific processing challenges.

Homogenizers ensure uniform distribution of fillers and other additives within rubber compounds, preventing inconsistencies that can compromise product performance. Dispersants break down agglomerated fillers, improving mixing efficiency and enhancing the mechanical properties of the final product. Anti-scorching agents control the curing process, preventing premature vulcanization during mixing and ensuring optimal crosslinking during production. Together, these product segments form a comprehensive toolkit that enables manufacturers to overcome complex processing hurdles and deliver high-quality rubber products.

Several key trends are shaping the future of Processing aids for natural rubber. The shift toward sustainability is driving increased investment in bio-based and renewable formulations, as regulatory bodies and consumers demand more eco-friendly manufacturing practices. This trend is expected to accelerate in the coming years, with bio-based Processing aids for natural rubber gaining greater market share as production costs decrease and performance continues to improve.

Another emerging trend is the customization of Processing aids for natural rubber for niche applications. Manufacturers are developing specialized formulations to meet the unique requirements of high-performance sectors, such as aerospace and advanced manufacturing. These tailored aids offer precise control over rubber properties, enabling the production of components that withstand extreme temperatures, pressure, and chemical exposure.

Additionally, the integration of digital technologies in rubber manufacturing is creating new opportunities for Processing aids for natural rubber. Advanced monitoring systems allow manufacturers to optimize the use of processing aids in real time, adjusting dosages and formulations to maximize efficiency and minimize waste. This data-driven approach is helping manufacturers unlock greater value from Processing aids for natural rubber while reducing operational costs.

The future of Processing aids for natural rubber is marked by strong growth potential and continued innovation. As the natural rubber industry faces evolving challenges—including supply chain volatility, rising energy costs, and sustainability mandates—Processing aids will remain essential to maintaining competitiveness. The market’s projected CAGR of 5.6% through 2031 reflects the critical role these additives play in enabling efficient, sustainable, and high-quality rubber production.

Key factors supporting this growth include the expansion of the automotive industry, particularly in emerging markets, and the increasing adoption of natural rubber in renewable energy applications such as wind turbine seals and solar panel components. Additionally, stricter quality and safety standards across industries will drive demand for high-performance Processing aids for natural rubber that ensure compliance and reliability.

Sustainability will remain a central focus, with bio-based and recycled Processius, with bio-based and recycled Processing aids for natural rubber expected to gain traction. As research continues to advance, these eco-friendly alternatives will likely become more cost-competitive, further accelerating their adoption. Manufacturers that prioritize sustainable processing aids will not only meet regulatory requirements but also gain a competitive edge in a market increasingly focused on environmental responsibility.

In conclusion, Processing aids for natural rubber are evolving from simple production enhancers to strategic assets that drive efficiency, sustainability, and innovation in the global natural rubber industry. With strong market growth projected over the next decade and ongoing technological advancements, these specialized additives will continue to play a vital role in shaping the future of rubber manufacturing worldwide. As manufacturers adapt to changing market dynamics and sustainability goals, Processing aids for natural rubber will remain indispensable to unlocking the full potential of natural rubber as a versatile and sustainable material.